Maintain availability in constantly evolving financial app environments

Customers are increasingly ditching brick-and-mortar locations in favor of making transactions from bank websites, mobile apps, and from multiple devices at all times of the day and night. Financial institutions need crystal-clear visibility into all of their customer-facing applications and platforms, whether relying on legacy systems or cloud-based infrastructure.

Maintain a competitive advantage by offering customers feature-rich web and mobile apps in performance-driven environments and monitor transactions from every point along the user journey.

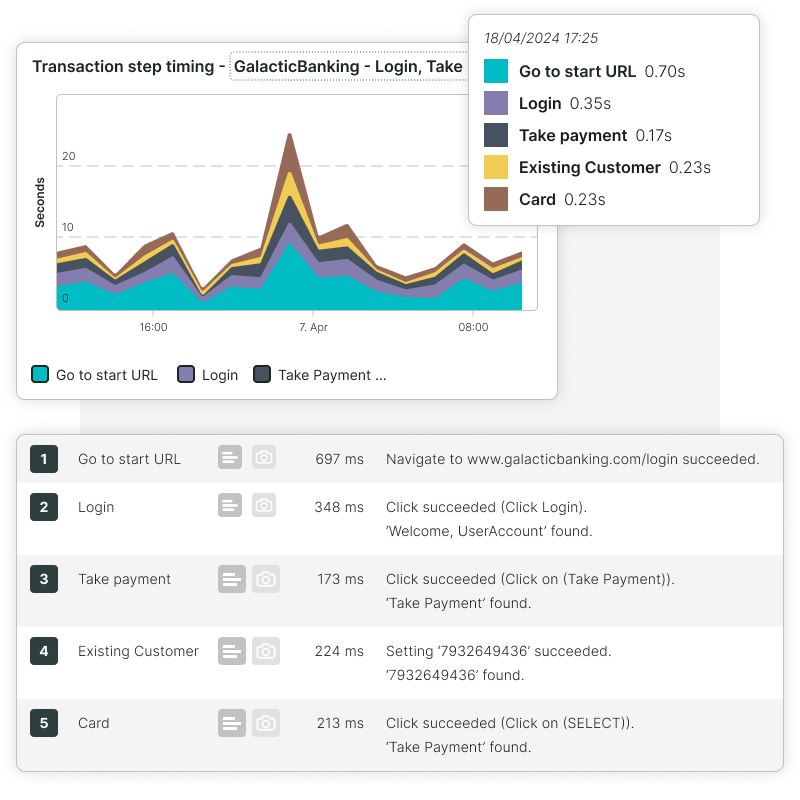

Monitor crucial transactions, every step along the way

Don’t be left in the dark wondering if the steps taken by customers are working as they should. Monitor critical user interactions for uptime and performance from 229 global checkpoints with Uptrends' Web Application Monitoring.

With our Transaction Recorder, it’s easy to start recording your transactions by following the same steps your users are taking, such as:

- Making or collecting payments.

- Connecting to merchant services.

- Validating user input.

- Receiving valid server responses.

Record with the Transaction Recorder

Uptrends’ Transaction Recorder is a Google Chrome extension that runs a Selenium-like script which allows you to track end user progress as they click through transactions on your site.

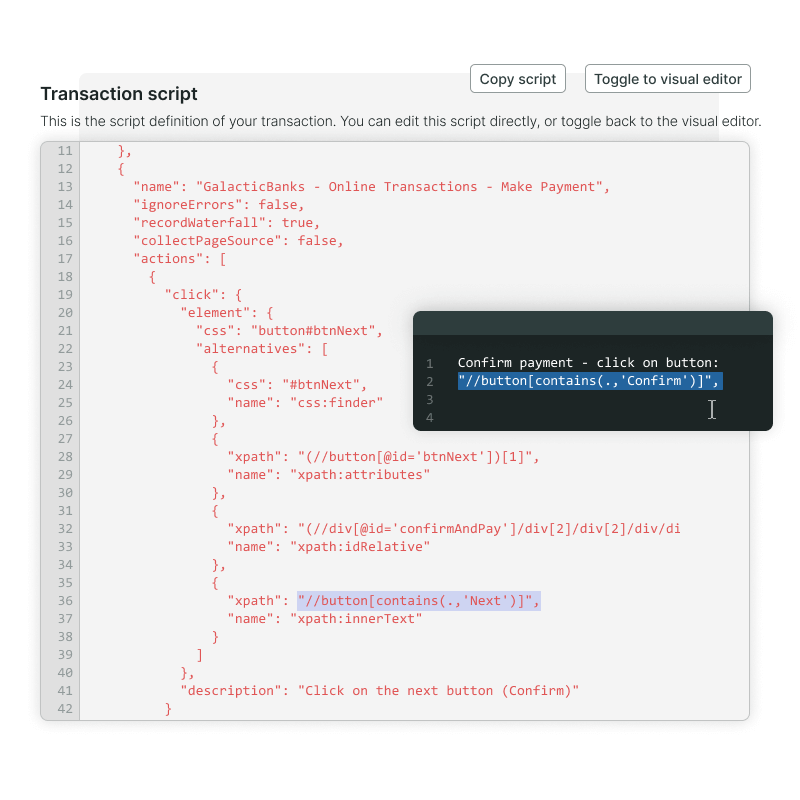

Edit your scripts in the Step Editor

Import your recorded script to view and edit the steps already defined (or create one from scratch). Test the scripts yourself or have our Support team handle the scripting and testing for you.

Check for performance bottlenecks

Waterfall charts will tell you exactly how long it took to load page elements along with request and response headers. Monitor individual step times for performance bottlenecks 24/7.

See what went wrong with error snapshots

Add error snapshots to transaction steps to view what users are maybe experiencing when a problem occurs - which makes troubleshooting and debugging errors easier.

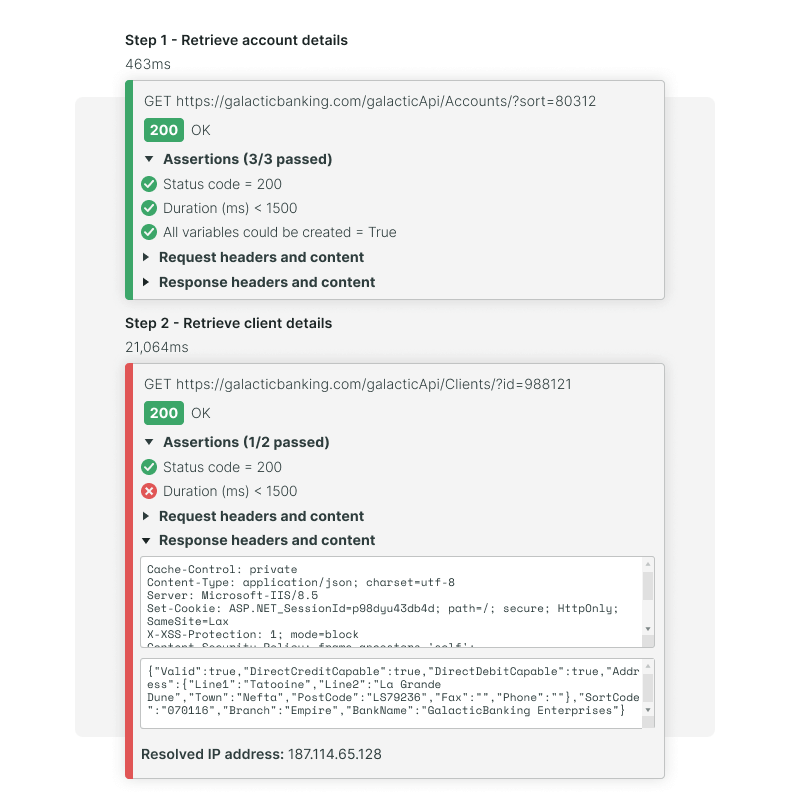

Know when APIs are not working as expected

With Uptrends' Multi-Step API Monitoring you can set up complex scenario’s with multi-step API calls. Features include:

- Setting the HTTP method, URL, request headers and request body for each request.

- Adding authentication (Basic, NTLM, Digest, and OAuth), using two-factor authentication (OAuth 2.0) or including client certificates to gain access to protected APIs.

- Extracting content and storing these in variables to reuse in any part of your scenarios.

- Defining assertions for each response to verify the HTTP status code, content checks, request duration, and more.

Define assertions for each response

Defining assertions (checks) for each response, to verify the HTTP status code, content checks (based on plain text, JSON content or XML content), request duration and more.

Add authentication or client certificates

Add authentication or include client certificates to gain access to protected APIs. In order to call a method in the actual API, an API client must first authenticate using OAuth authentication, for example.

Upload files from the vault

You can upload files from your vault as part of one of your request steps. Any HTTP steps you configure in the Multi-step API monitor that contains a request body may be either a file upload or a regular plain text request.

Edit directly in the script editor

Just like transaction monitors, the Multi-step API monitor type comes with a script view editor as an alternative to the default visual editor. Make changes to the steps of your monitor much like the visual editor — but in a JSON script instead of the UI.

Some users find making edits directly in the script easier than navigating the visual editor and having a script available enables automation — saving time and money.

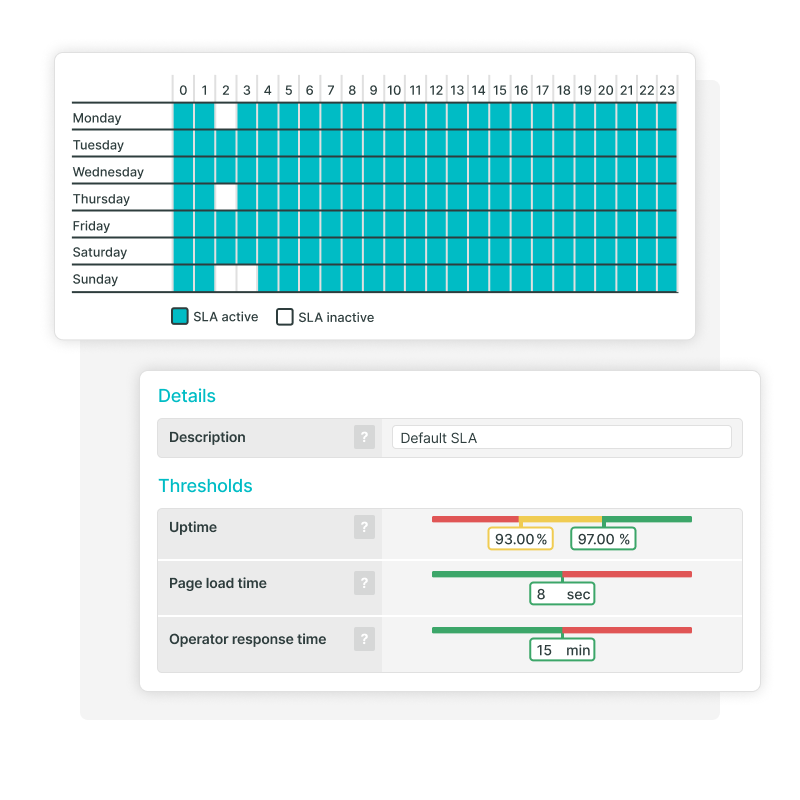

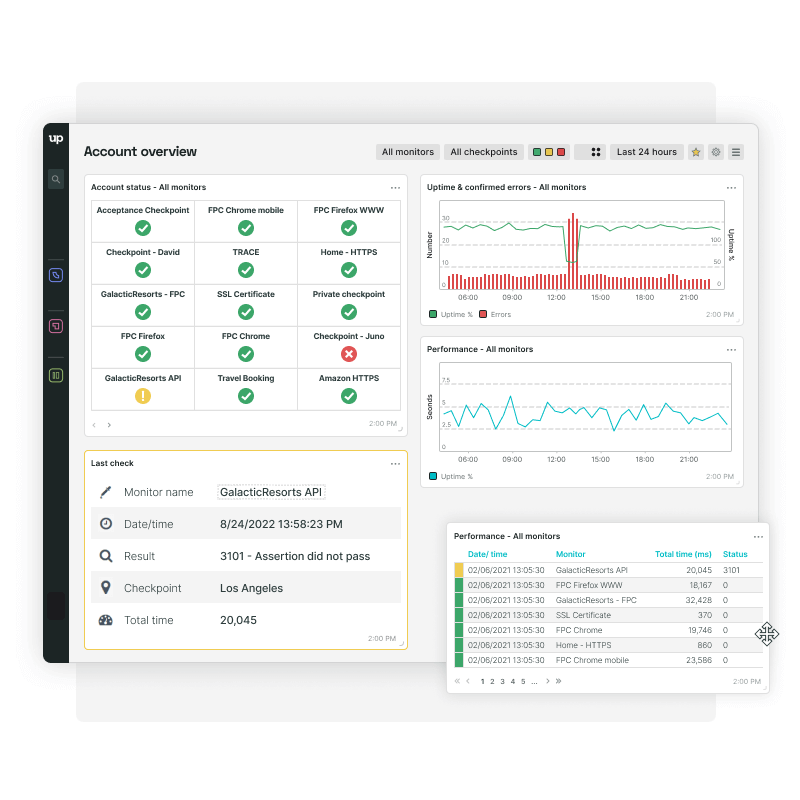

Keep an eye on service level agreements

Being able to process massive amounts of data while retaining high availability and transactionality, is the bread and butter for many financial services enterprises.

Monitor your SLA to ensure your provider meets the agreed metrics and your online platforms and servers are always up and running:

- Set up thresholds for error uptime percentages, desired uptime percentages, page load time and operator response time.

- Add SLA schedules to specify times when your SLA is active.

- Download and share SLA overview reports easily with PDF and Excel exports.

Stay in sync with business-critical systems

Keep an eye on uptime and availability with Uptrends’ Advanced Availability Monitoring.

- Know that your SSL certificates haven’t expired.

- Know when your users always reach their intended destination by monitoring your DNS A, AAAA, CNAME, MX, NS, SOA, and TXT records.

- Leverage FTP monitor types to verify the availability of files and check authentication processes.

“Before Uptrends, we didn’t have insights into our real uptime, but now we do.”

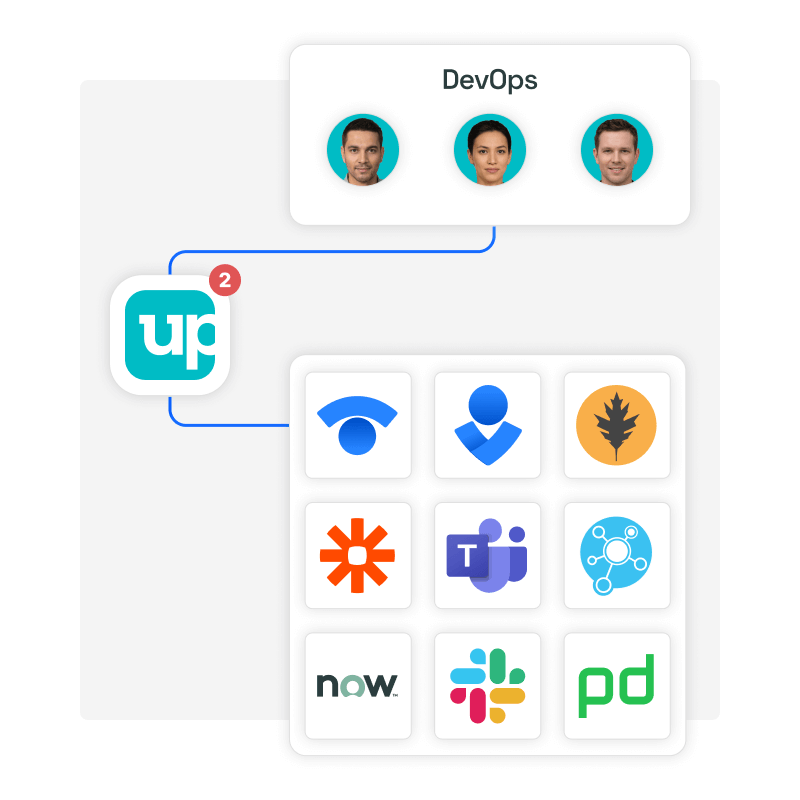

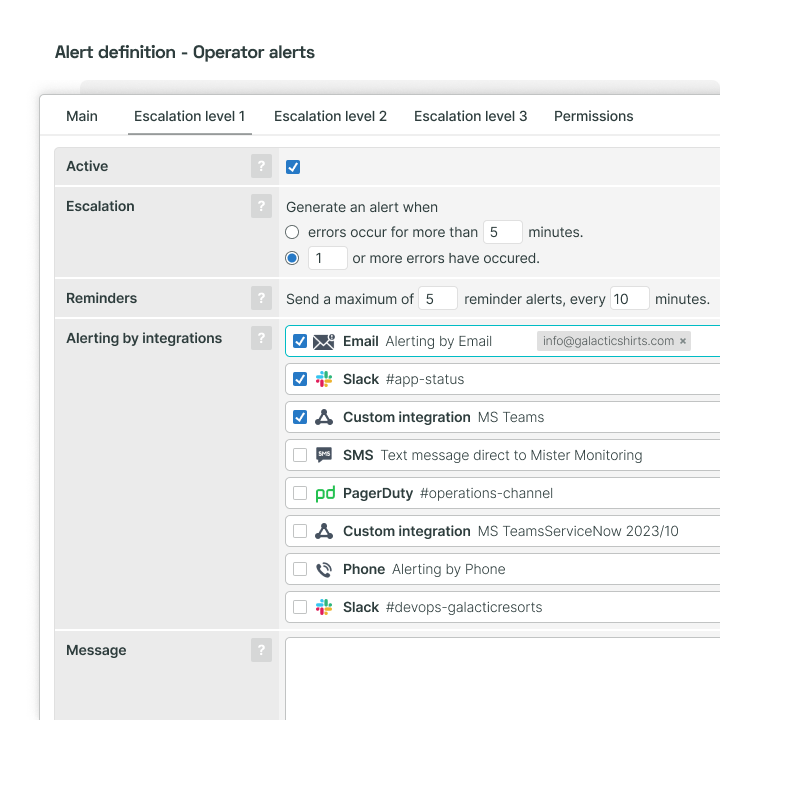

Alerts when and where you want

Every minute of downtime or performance-related issues faced by financial organizations can result in enormous revenue losses — not to mention damage to your brand and reputation.

With Uptrends' alerting, you can send customized notifications to your team members so they can restore systems quickly.

Notifications on your terms with integrations

Uptrends offers a number of ways for notifying your team members. Get notified via Uptrends' default alerting methods, such as phone/voice messages, SMS/text, and e-mail. Set up custom alerting via integrations such as:

- Popular services including Slack, Microsoft Teams, Pagerduty, Splunk On-Call, Statuspage and Zapier.

- Use the Uptrends API to process alert and monitor data into your automated worfklow.

- Build a custom integration to connect to any system.

Data security compliance

Data breaches are serious issues for businesses of all sizes but even more so for financial institutions holding sensitive personal information. Uptrends is serious about data security compliance in all aspects of our operation.

Uptrends is ISO 27001 security compliant

Uptrends achieved and maintains its ISO 27001 compliance to guarantee you that we have the processes and procedures in place to keep your information safe.

Keep your sensitive information safe in the Uptrends Vault

The Uptrends Vault encrypts your sensitive certificates, keys, and credentials. The vault makes them accessible but not visible in your monitor settings or your reports.

GDPR compliant

GDPR compliance is a European Union requirement that affects the collection, storage, transfer, and use of personal data. Uptrends is fully compliant with the regulation.

Try Uptrends Transaction Monitoring for free

Today’s financial services firms face ever-growing demands from customers for speed, reliability, and flexibility. With so much on the line, Uptrends’ Transaction Monitoring needs to be at the forefront of your mind for the business of financial services.

Try Uptrends 30 days for free