The challenge

What stands between you and reliable, real-time banking APIs?

Third-party dependencies are a monitoring blind spot

When third-party APIs disrupt banking services, teams spend hours investigating your own application due to a lack of visibility.

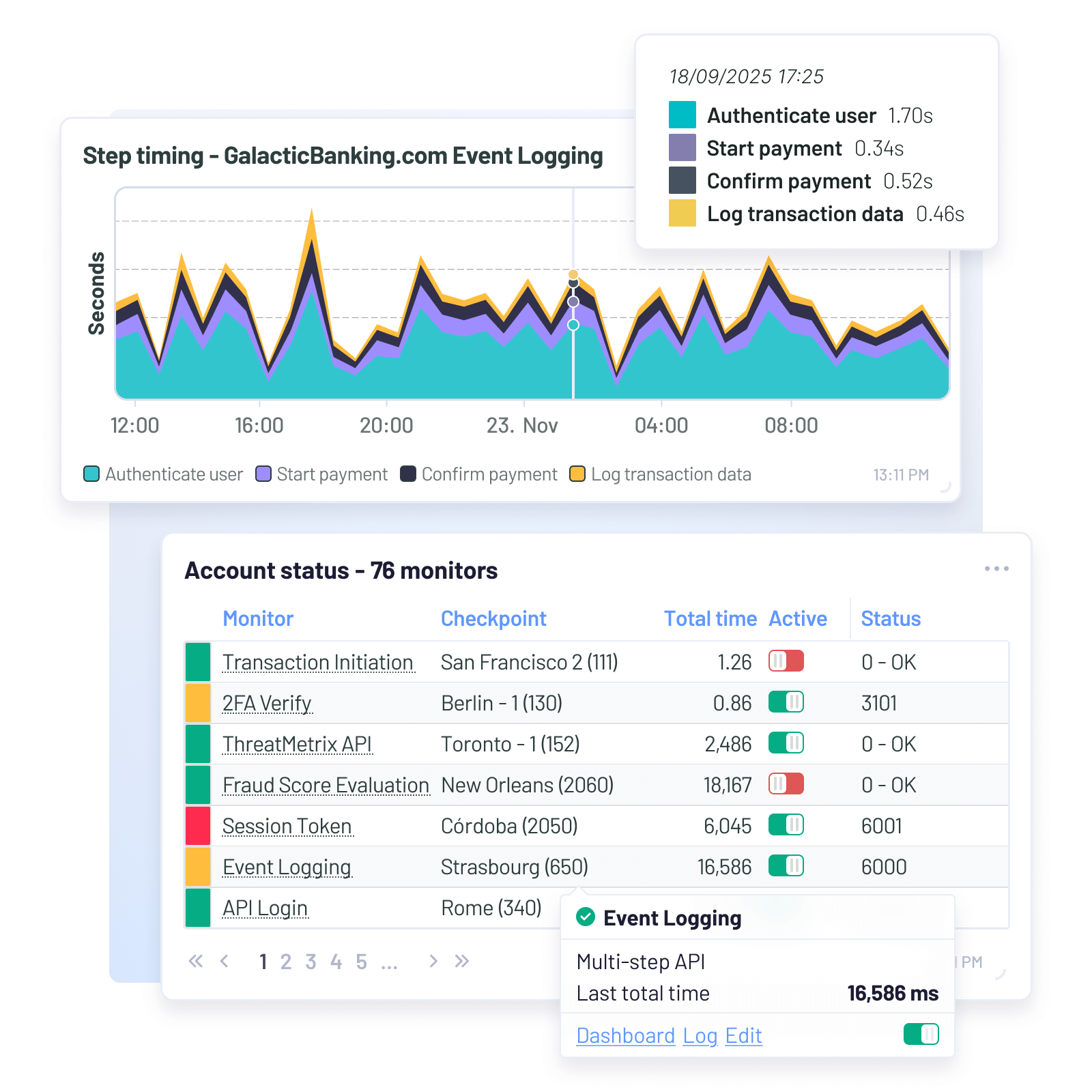

Unmonitored latency for your critical API workflows

Checking uptime isn’t always enough. Slow or delayed API responses can cause transaction failures or operational bottlenecks.

Lack of oversight for third-party SLA compliance

Without standardized API monitoring across your vendors, you struggle to prove SLA compliance and service-level reliability.

Uptrends is the top-rated tool for API monitoring across all vendors

As highlighted in the 2024 Gartner® Critical Capabilities for Digital Experience Monitoring.

Unmatched global coverage

229 checkpoints across 67 countries.

Real-world API insights

100% true API performance insights.

Fast end-to-end setup

5 min until API performance insights.

Online payment processing

Track every API call in your payment flow

From a customer initiating a payment through to a payment gateway (e.g. Stripe or PayPal) confirming completion, understand the full API flow of a transaction to rapidly identify bottlenecks or failures and inform resolution.

- Track API performance: Monitor the response times of each API call and prevent delays to payment processing.

- Detect response errors: Identify failed transactions due to issues like authorisation denials or network errors.

- Maintain availability: Check third-party services, such as Visa or MasterCard networks, are operational to mitigate disruption.

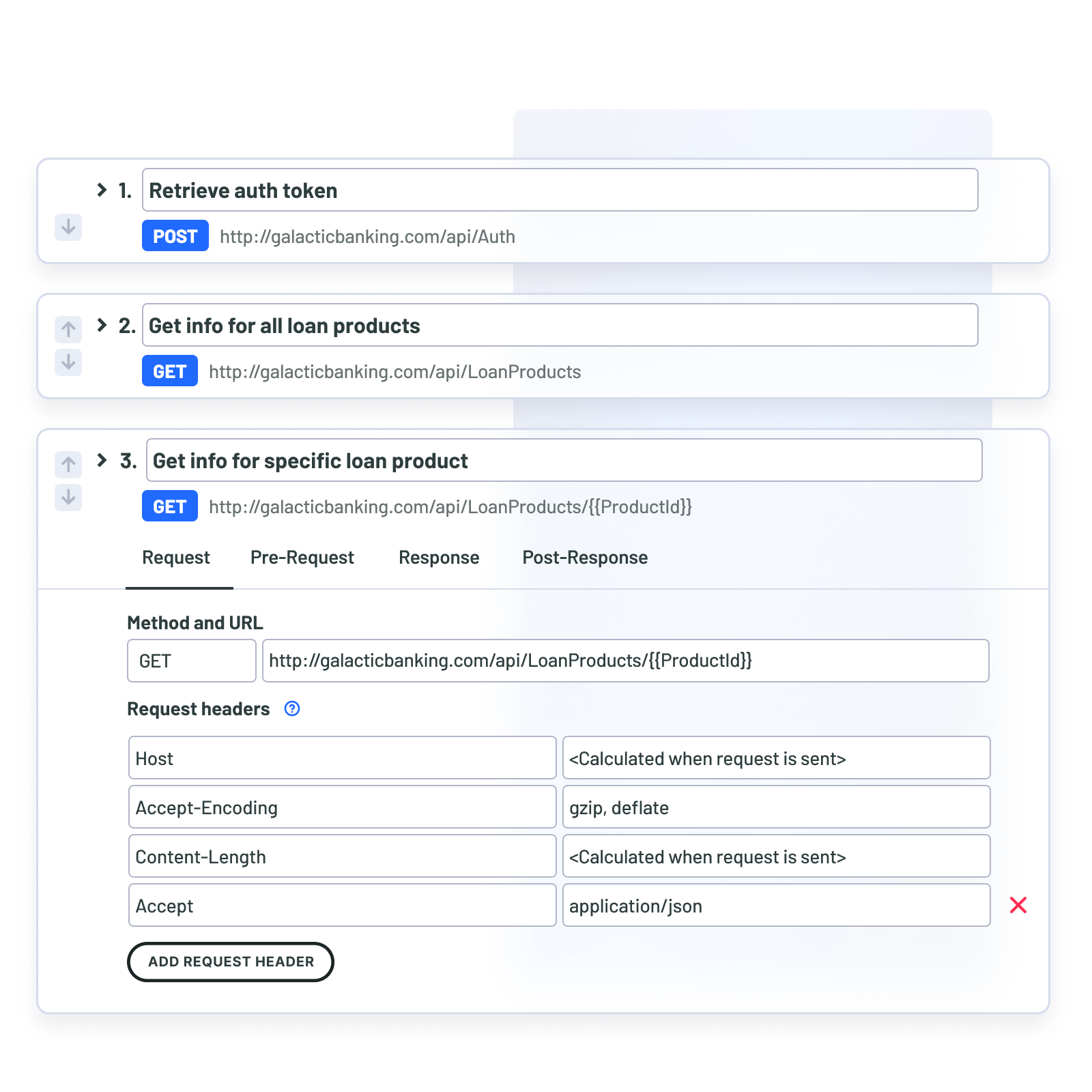

Loan application processing

Keep loan applications timely and compliant

Customer loan applications rely on APIs to securely pass through a third-party credit scoring service (e.g. Experian or Equifax) and your internal underwriting system. Accelerate issue resolution and uphold regulatory compliance.

- Measure response time: Track the latency of credit scoring APIs in real time to protect smooth application processing.

- Log errors: Capture detailed instances where credit score retrieval fails to facilitate prompt resolution.

- Verify compliance: Check all data exchanges fully comply with regulatory standards for security and data privacy.

Create your first API monitor in minutes

No coding required (unless you like to customize). No credit card needed.

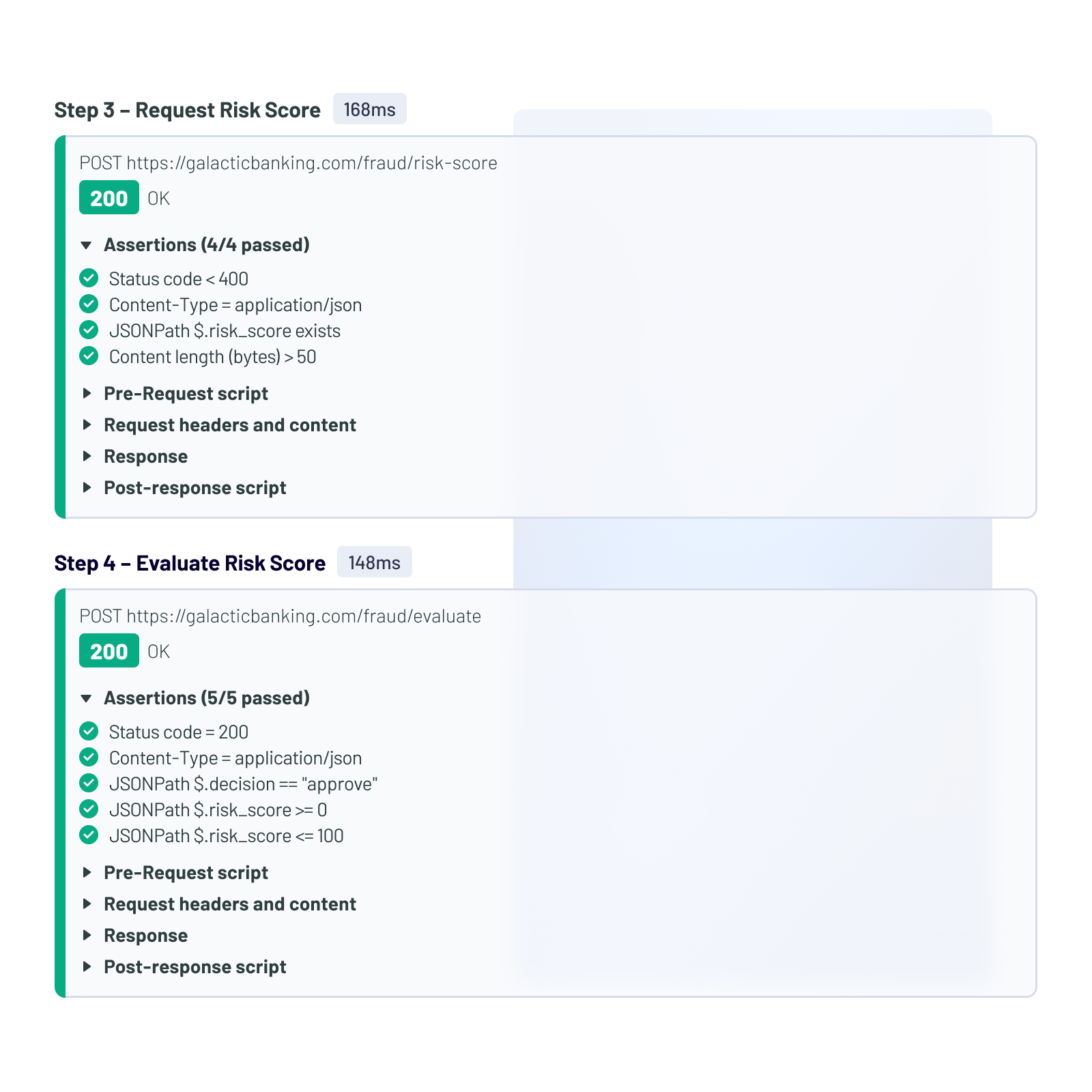

Transaction fraud detection

Maintain fast, reliable fraud prevention

When a customer makes a high-value transaction, a third party (e.g. ThreatMetrix or Kount) must evaluate it and provide a risk score that then determines next steps. Make certain your fraud prevention process is both fast and robust.

- Trust in real-time analysis: Ensure you receive instant risk assessments from fraud detection APIs to help mitigate fraud.

- Evaluate accuracy: Monitor the consistency and long-term reliability of risk scores returned by your scoring engine.

- Sustain seamless integrations: Verify communication between your bank’s transaction systems and your fraud detection service.

Stop guessing, start knowing with ITRS Uptrends

Before Uptrends

- Hours wasted investigating your own application due to an external problem.

- Constant reactive firefighting because of silent API failures.

- Challenges with automating reliable monitors for multi-step API flows.

With Uptrends

- Rapidly pinpoint critical issues with third-party APIs before they fail.

- Receive insightful, actionable alerts as soon as something goes wrong.

- Easily simulate complex API flows in testing and production environments.

Free 30-day trial

Try API monitoring for free today

Start monitoring your APIs and get 30 days of free access to advanced API performance tracking, API uptime monitoring, and real-time error detection. No credit card required.

Frequently Asked Questions

If you'd like a closer look or personalized guidance, we'll be happy to show you how Uptrends API monitoring can be tailored for your specific use cases.

Book my 1-on-1 demoUptrends gives you consistent, standardized monitoring across all third-party APIs, so you can track uptime, response times, and error rates for every vendor in one place. You can generate scheduled SLA reports with only a few clicks.

Uptrends helps you stay compliant with secure data handling, private checkpoint deployment, and audit-friendly reporting. Monitor sensitive API flows without compromising on privacy, performance, or regulatory obligations.

You get immediate, actionable alerts delivered via your preferred channels including email, SMS, or integrations with tools like Slack and ServiceNow — so you can stay ahead of issues before they impact users.

Absolutely. Use our global public checkpoints for third-party APIs and easily deploy private checkpoints behind your firewall to monitor internal services.

Our low-code editor makes it easy to configure even the most advanced scenarios. Add custom headers, define conditions, chain multiple steps, and use variables — no dev time needed, unless you want it.

From high-level SLA summaries to granular response time breakdowns, Uptrends gives you the insights you need to optimize performance, demonstrate compliance, and inform decisioning across teams and time zones.